- Milk Road Macro

- Posts

- 🥛 The 17 most important charts right now 📊

🥛 The 17 most important charts right now 📊

What’s really going on in markets?

GM. This is Milk Road Macro, the market update that’s more addictive than checking your phone right before bed. You won’t want to miss what’s in store.

Here’s what we got for you today:

✍️ Let’s take the temperature of markets

🎙️ The Milk Road Show: The US Economy Is Re-Accelerating & Why Cutting Rates Now Would Be a Disaster w/ Danny Dayan

🍪 Trump won’t set reciprocal tariff rates below 15%

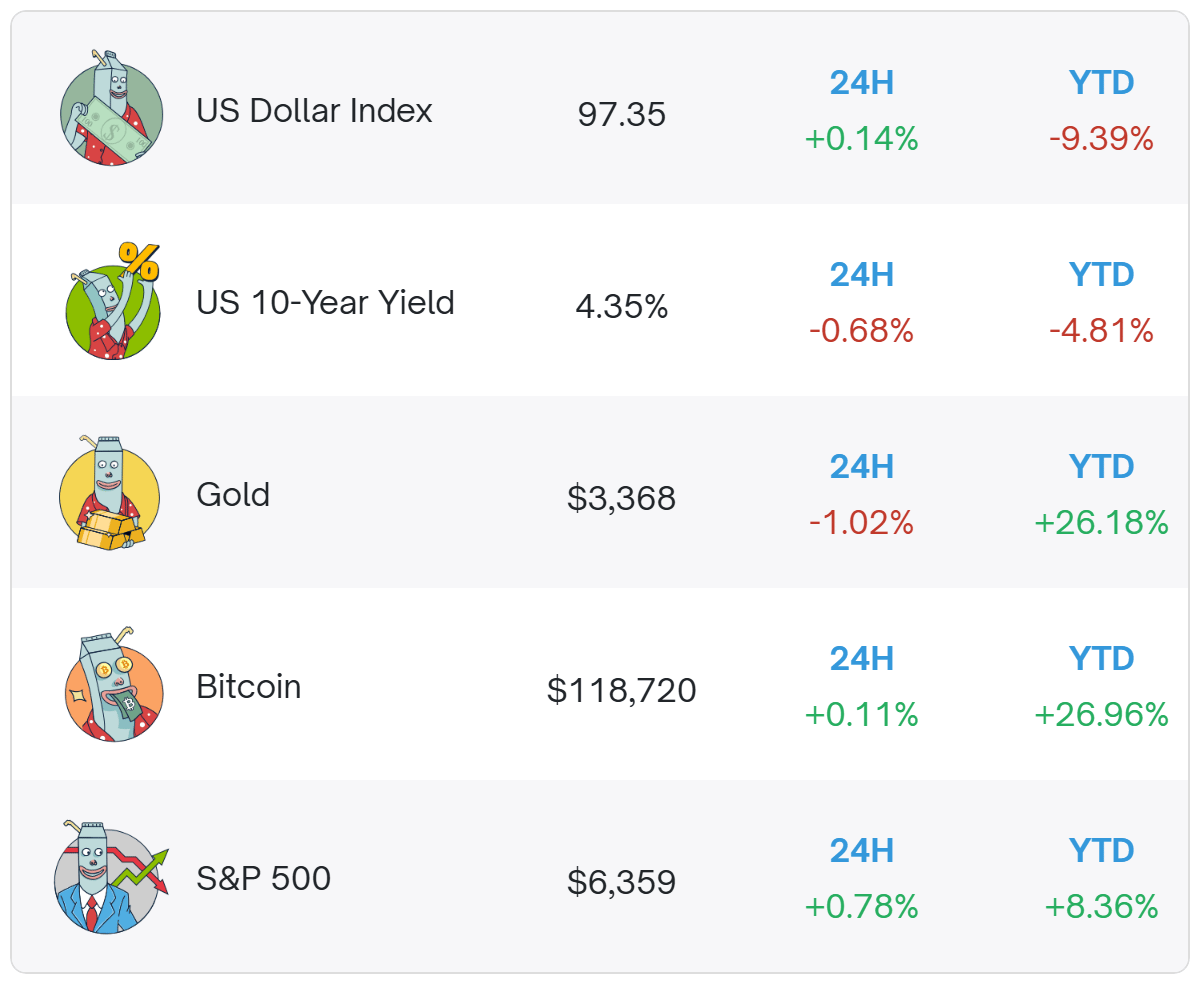

Prices as of 8:00 AM ET.

LET’S TAKE THE TEMPERATURE OF MARKETS (IT’S QUITE WARM)

It’s been a crazy few weeks in markets.

Stocks just continue to grind higher after an already impressive run-up.

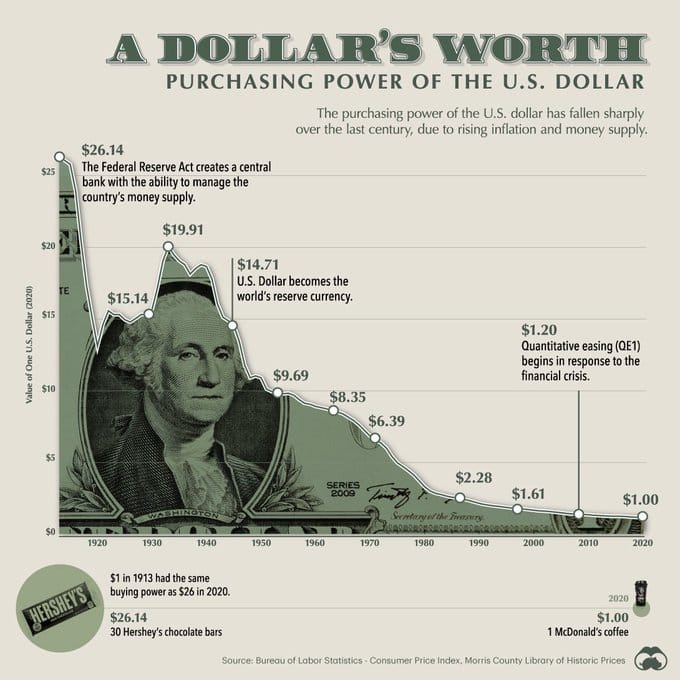

The dollar just keeps on falling.

Bitcoin has hit a new all-time high - while many other cryptocurrencies have also been showing impressive strength.

And there are even hints of a new 2021-style meme stock craze emerging.

So, let’s take the temperature of markets and see what’s really going on.

Here are the 17 most important charts in markets and the economy right now…

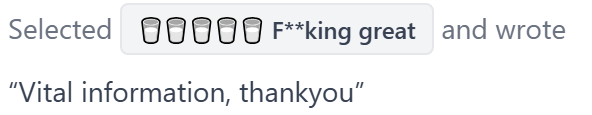

Everybody is bearish on the dollar - time for a reversal?

The dollar, as measured by the Dollar Index (DXY), has been nosediving all year - which is generally good news for risk assets.

But “short dollar” is now the most crowded trade in the world, according to Bank of America’s Global Fund Manager Survey.

It topped the pile for the first time ever this month, taking over from “long gold”.

A contrarian might think it’s now time for a consolidation or upward retracement for the dollar.

It’s rare that a trade continues to perform when sentiment is this crowded.

We also have an ongoing structural tailwind for the dollar over the next couple of months - the TGA rebuild (which I explained here).

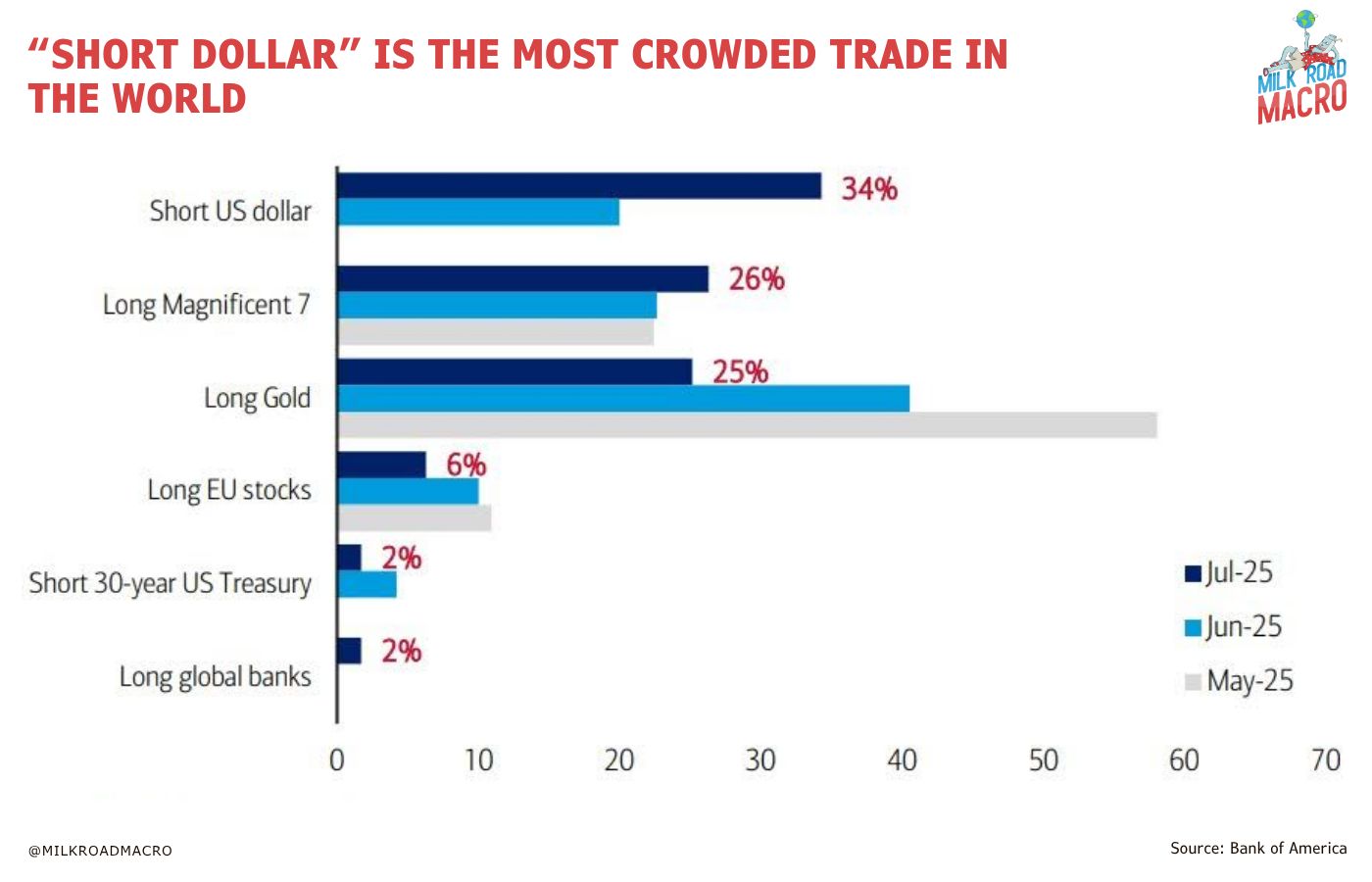

US Government debt interest costs just keeps growing

US Government debt interest costs remain sky high.

Costs currently sit at around $1 trillion per year, up from $300 billion in 2021.

This crazy chart is the main reason why President Donald Trump is continuing to attack Fed Chair Jerome Powell and demand rate cuts.

According to Bank of America, a 3.25% Federal Funds Rate would stabilize interest costs and Fed Funds at 2% would cut interest costs by $200bn.

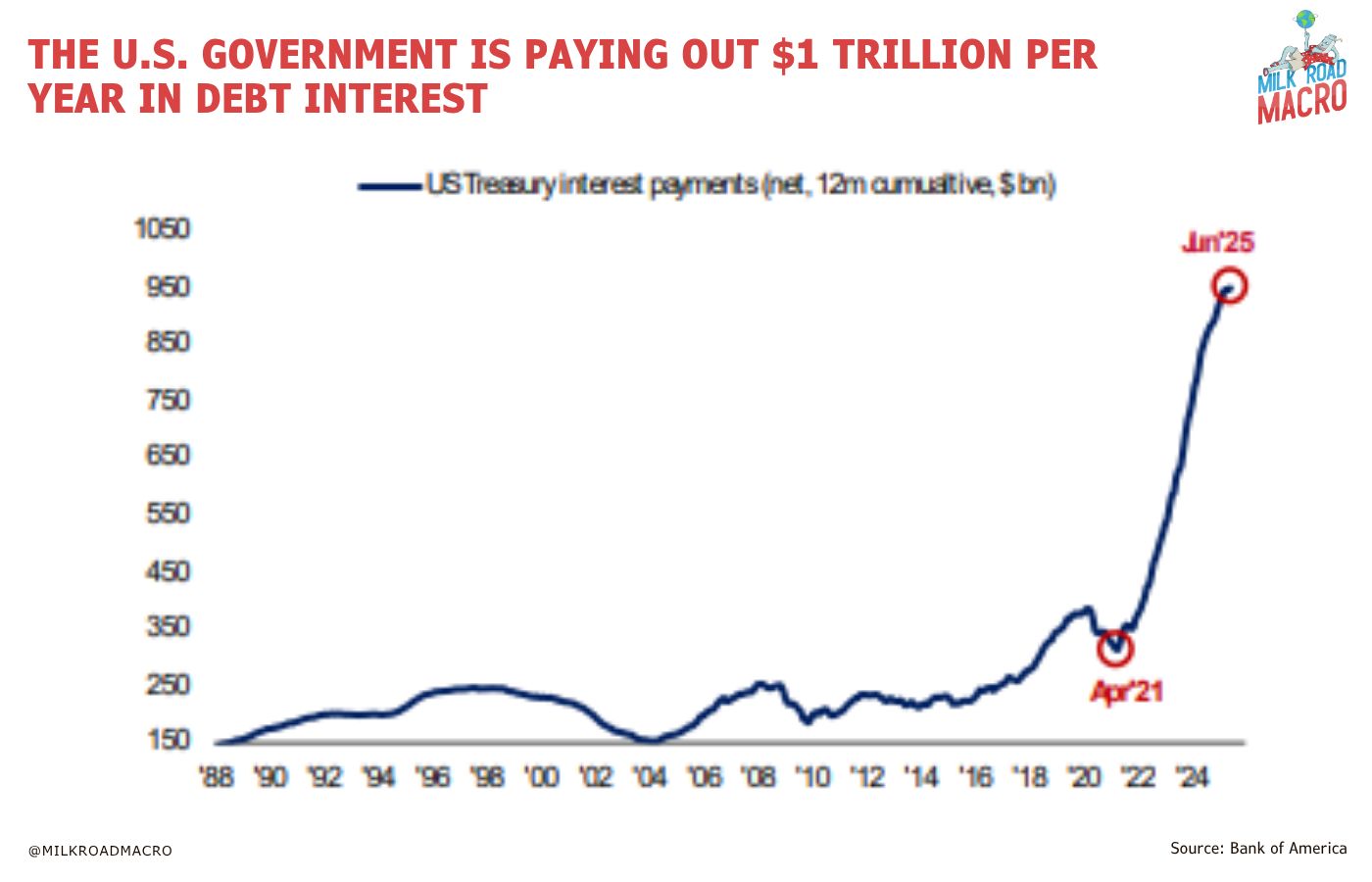

Ballooning fiscal deficits are not helping the interest payment picture.

Despite previous promises from the Trump team to cut spending, the deficit for the 2024/2025 fiscal year is currently tracking above recent years (which were already high).

While unsustainable in the long-term, this kind of extreme deficit spending is stimulative for the economy and financial markets in the medium-term.

Growth scare is over

Measures of the strength of the US economy continue to recover after a “growth scare” earlier this year.

The Citi Economic Surprise Index (CESI) measures whether a wide range of US economic data releases are coming in above or below expectations.

CESI was falling throughout early 2025 but has now stabilized and has marched higher into positive territory over the past few weeks.

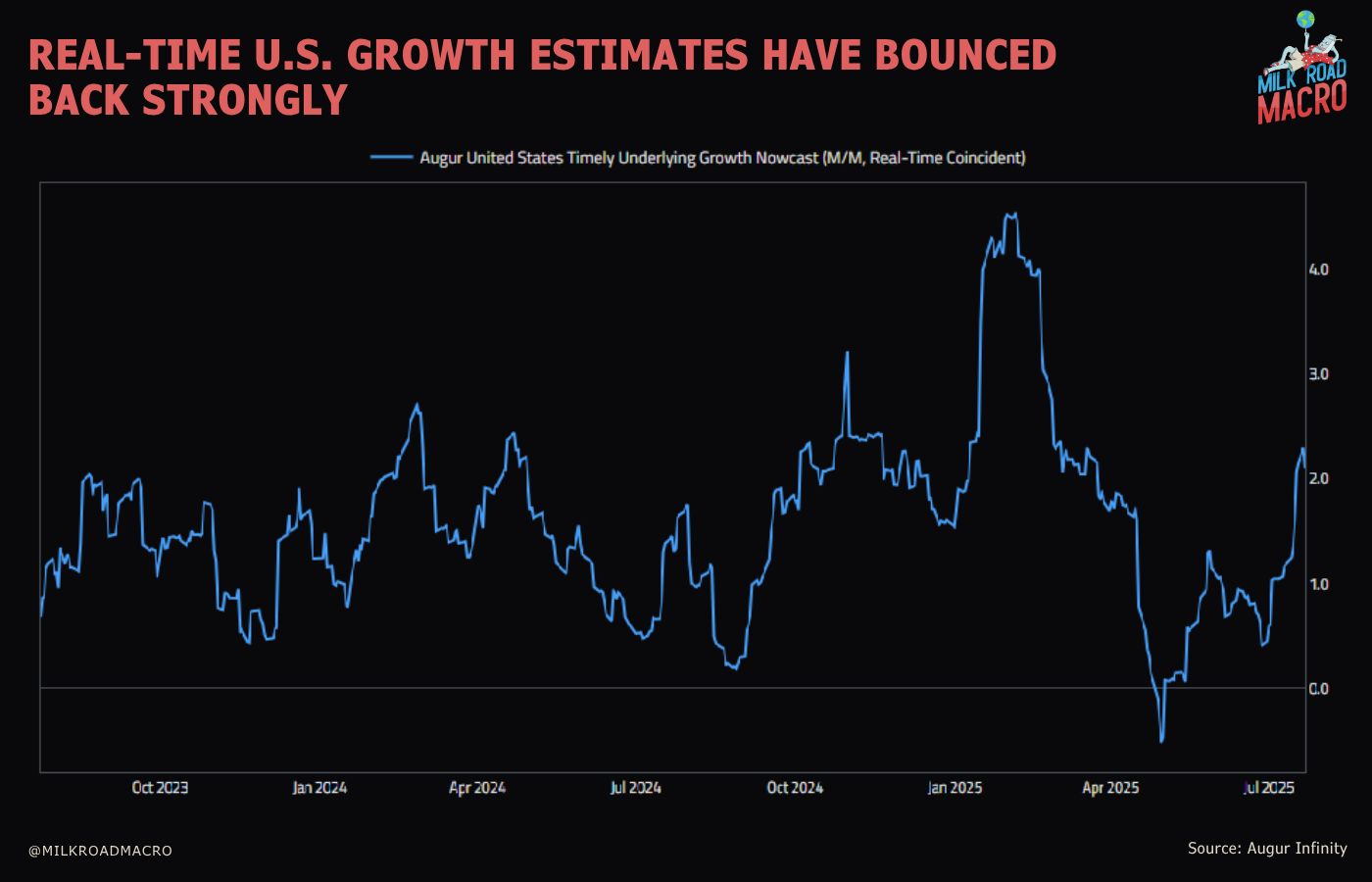

It’s a similar picture when looking at Augur Infinity’s US growth nowcast.

This estimates the real-time growth of the US economy by taking in a large number of data points.

It nosedived in early 2025, but has bounced back just as strongly since April.

As economic data continues to show a resilient US economy, credit risk and recession risk continue to move lower.

(“Ahhhh” – you hear that? That’s the market breathing a sigh of relief)

This relief is seen through corporate credit spreads (the difference in yield between a corporate bond and a risk-free government bond of similar maturity), which are hovering around multi-year lows.

Low credit spreads allow corporations and businesses to take out debt more easily to fuel future growth.

But there’s still money waiting on the sidelines

The positive economic outlook has led to a historic rally in US equity indices since the early April low - basically a straight line up with virtually no “buyable dips”.

It’s inevitable that some sort of pullback will come… eventually.

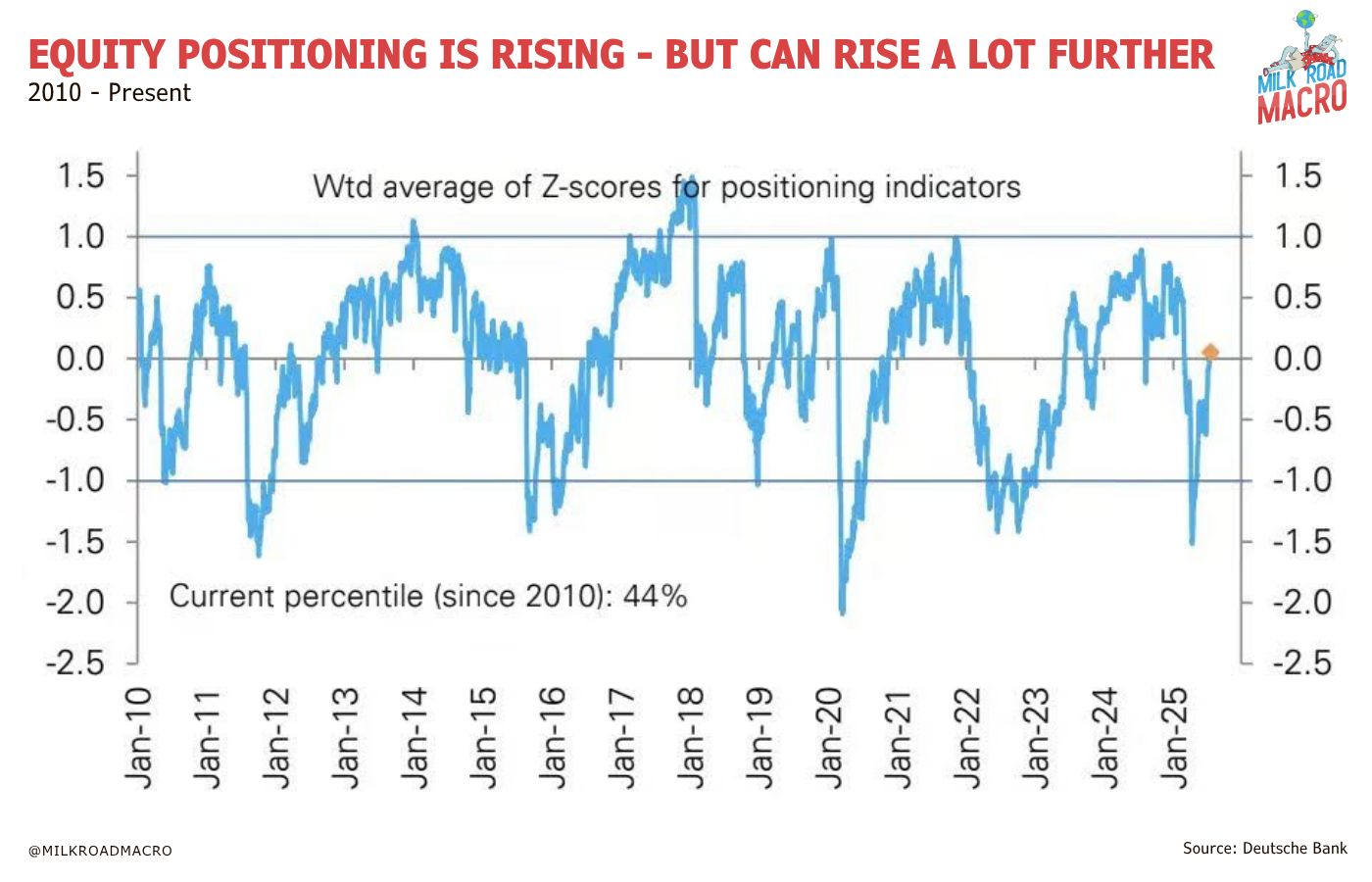

However, positioning has still not reached complacent levels.

A lot of big money is still sitting on the sidelines, after missing the vicious “v-bottom” in stocks.

Deutsche Bank’s Equity Positioning model finally ticked into "overweight" territory (above zero) this week.

But it’s still a way off the complacent levels we saw throughout large parts of 2023 and 2024.

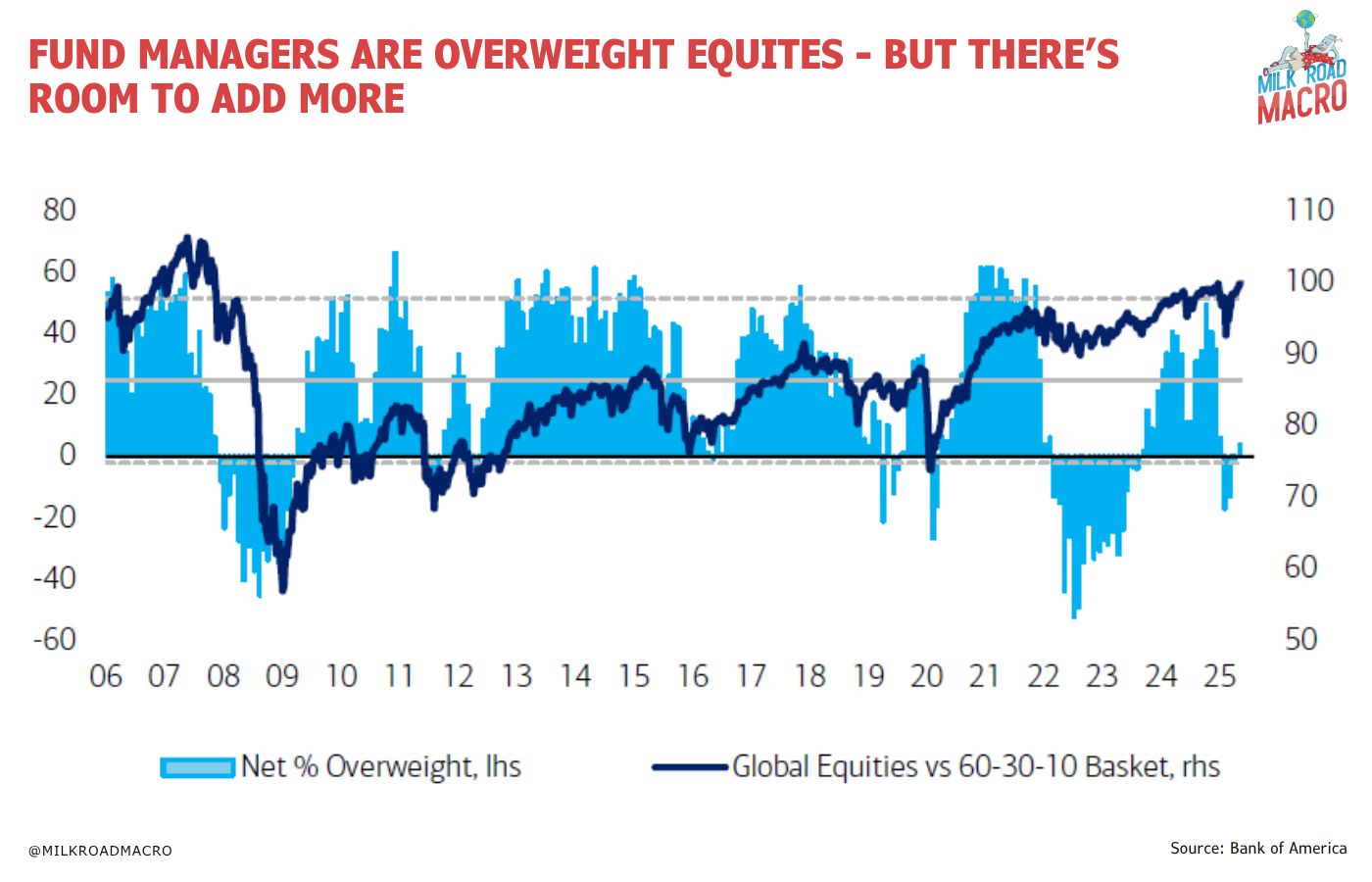

Bank of America's Global Fund Manager Survey shows a similar picture.

The net percentage of Fund Managers overweight equities (light blue histogram) has moved marginally back into positive territory.

But there’s a lot of room for Fund Managers to load up on more stocks, according to historical precedent.

SentimenTrader’s Advisor and Investor model, which aggregates a number of popular investing sentiment surveys, is getting close to excessive optimism (0.75+), but is not yet there.

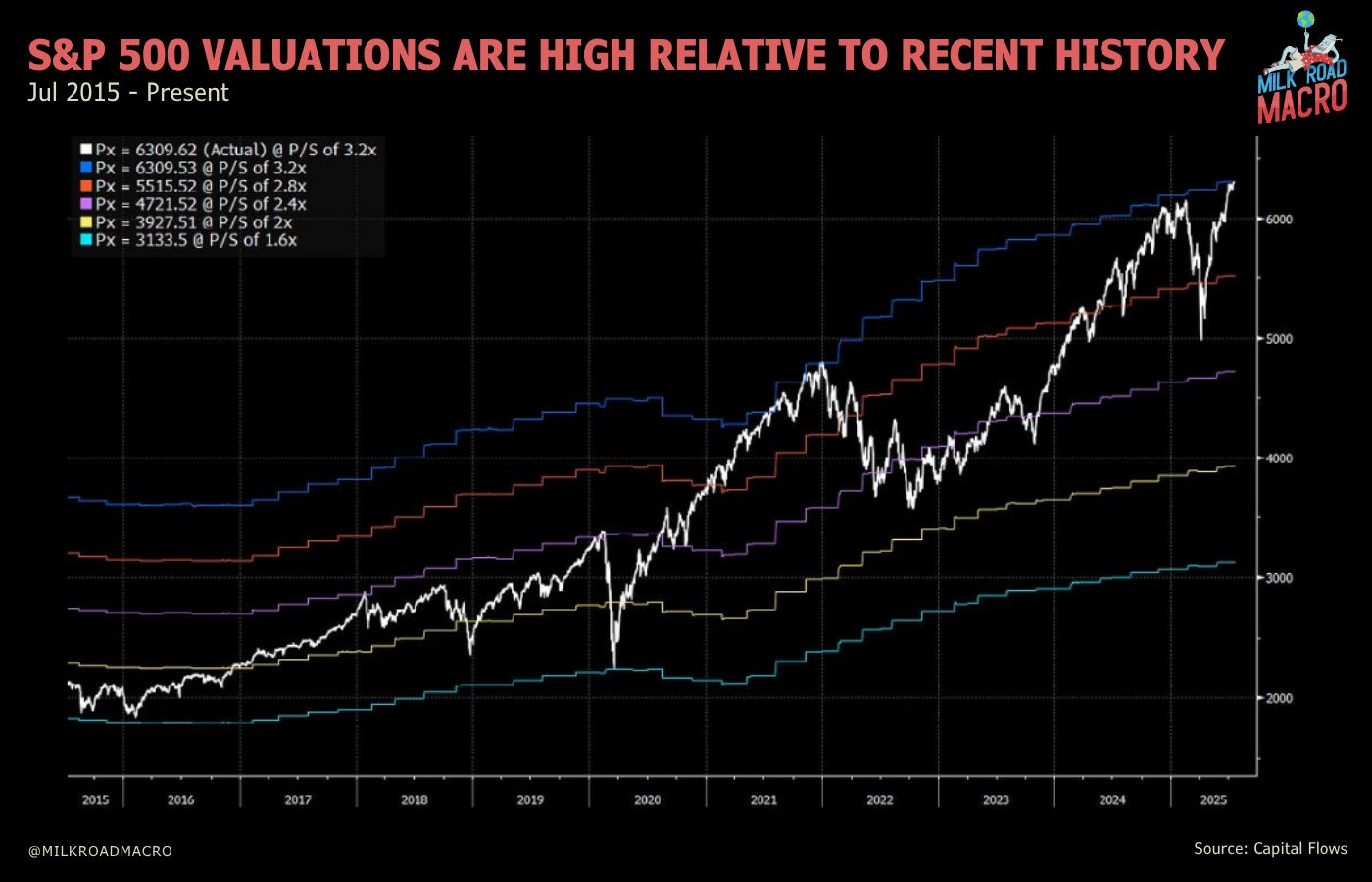

A cautionary sign would be that equity valuations are pushing to the top end of their historical range.

The S&P 500 is currently sitting at a 3.2x price-to-sales ratio.

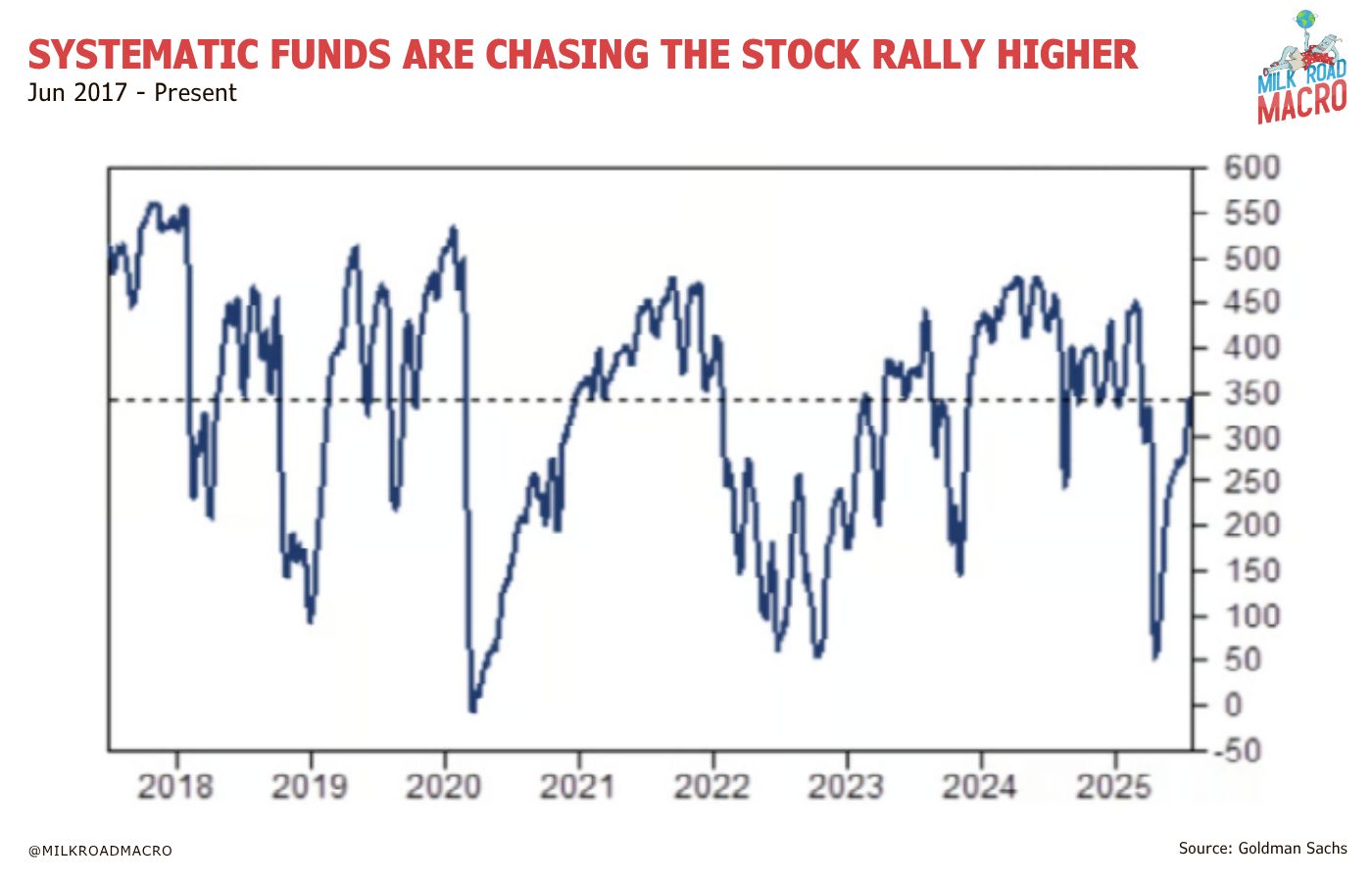

But systematic buying is continuing to fuel the rally higher.

Systematic strategies couldn't care less about traditional valuation metrics.

They just relentlessly buy under specific circumstances - and there’s no stopping it.

I wrote about one aspect of this - vol control funds - recently.

And systematic strategies are still expected to chase the rally further under most circumstances.

Goldman Sachs estimates that systematic funds will “continue to buy $107bn of global equities over the next one month in the baseline scenario”.

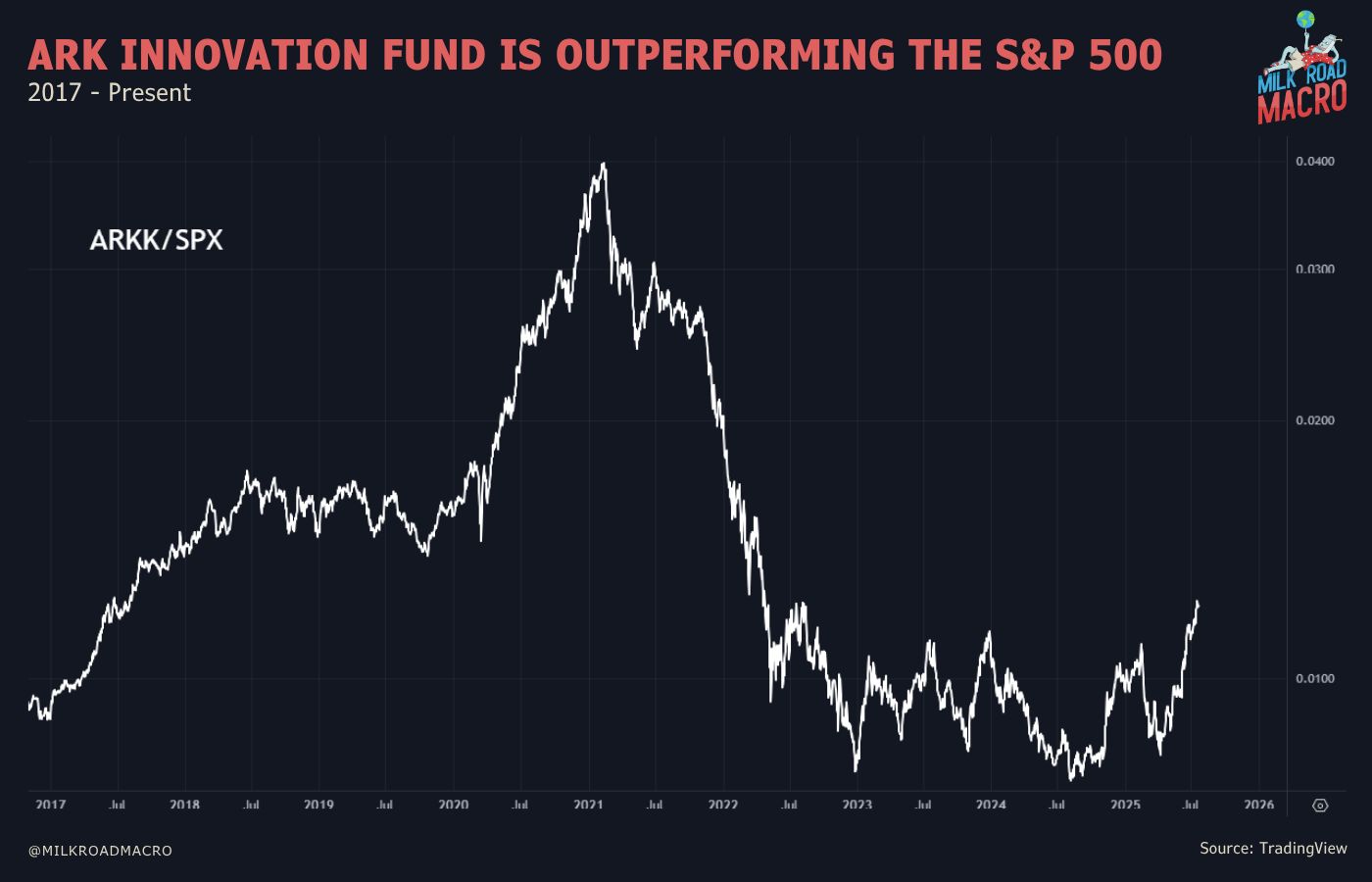

Speculation spreading

The risk-on environment is spreading as investors move further out on the risk curve.

This is evident when looking at ARK Innovation Fund (representing the more speculative end of the stock market) relative to the S&P 500.

ARK is outperforming the S&P 500 at a rate not seen since 2020/2021.

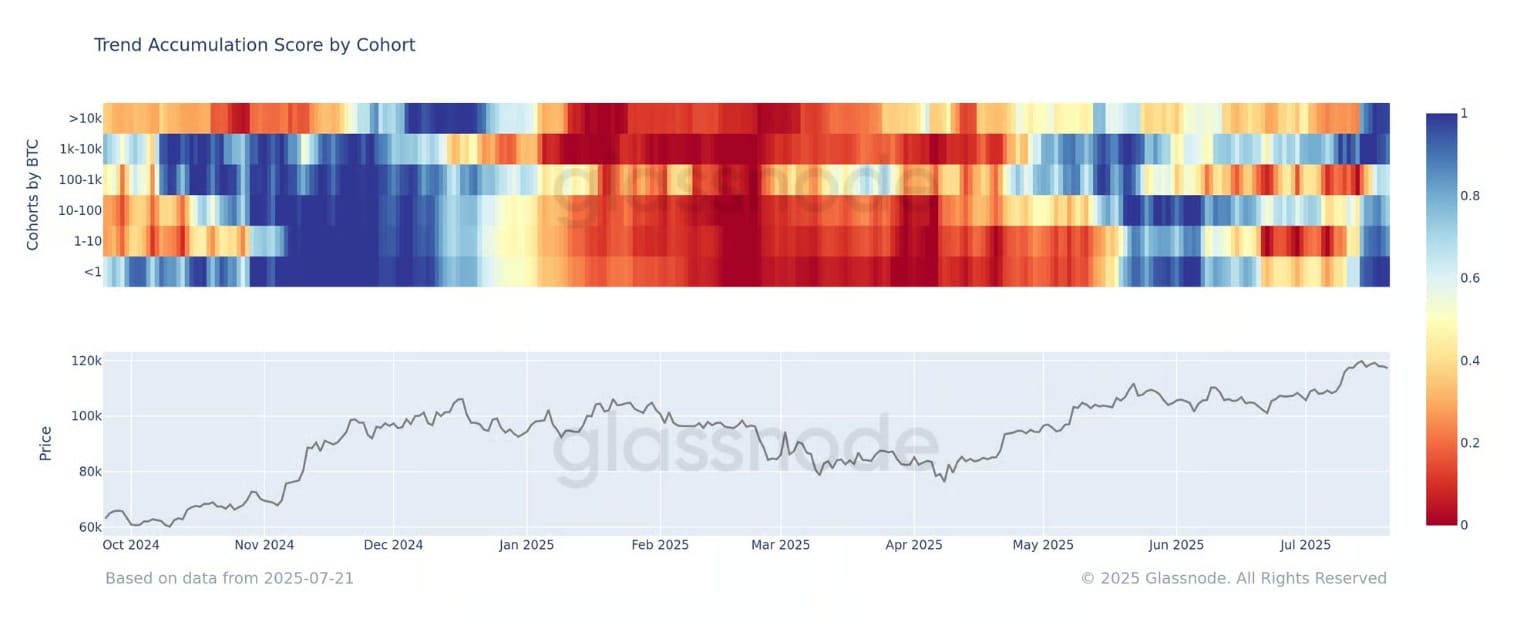

Bitcoin has blasted to a new all-time high, while other cryptocurrencies have also started moving up strongly.

But despite bitcoin’s impressive 60% rally from its April lows, there’s no sign of investor accumulation slowing.

According to Glassnode:

"All major bitcoin cohorts by wallet size are back in near-perfect accumulation mode. Even >10K BTC whales are participating at levels last seen in Dec 2024. The alignment across wallet sizes suggests broad-based conviction behind the current $BTC uptrend."

And Ethereum buyer behavior also looks promising, with first-time buyers entering the market for the first time in a long time.

According to Glassnode:

"We’re seeing the first signs of a trend reversal in $ETH buyer behavior. Since early July, the supply held by first-time buyers has increased by ~16%, suggesting renewed interest and inflows from fresh market participants."

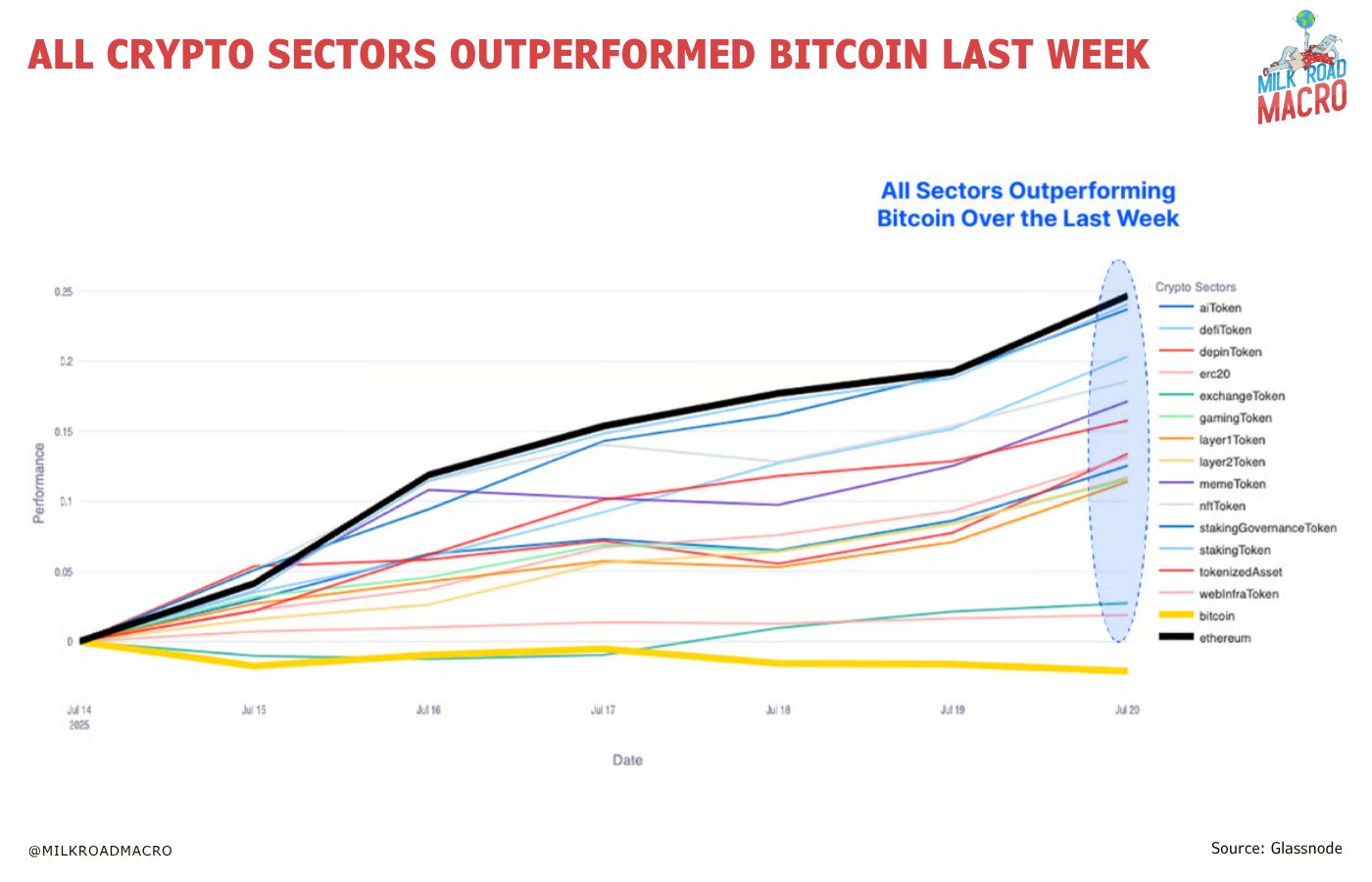

Capital rotation is clearly evident within the crypto market.

According to Glassnode:

"All other digital asset sectors are now outperforming [Bitcoin], led most notably by Ethereum. This mechanic is a classic example of capital rotation along the risk-curve."

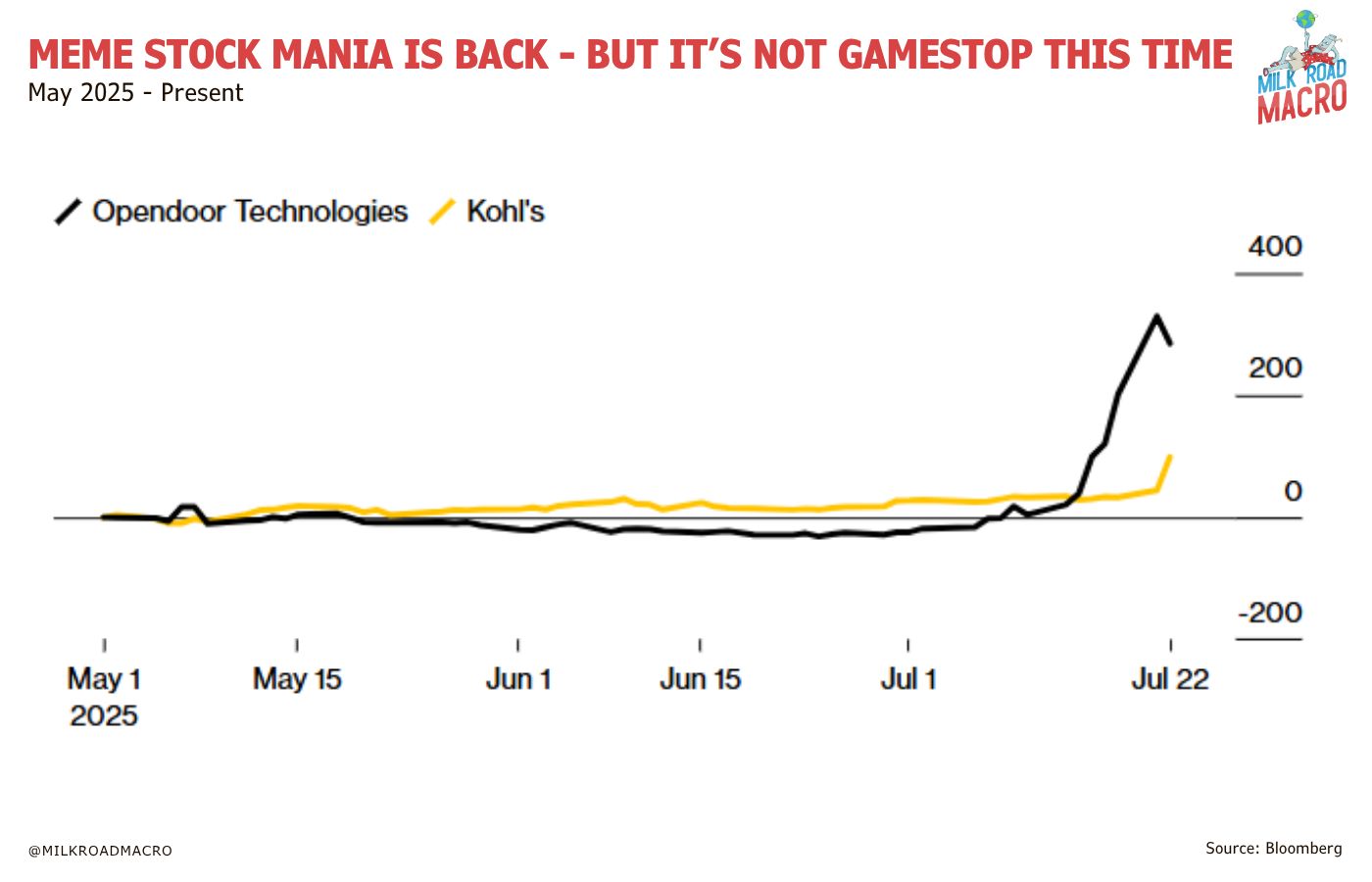

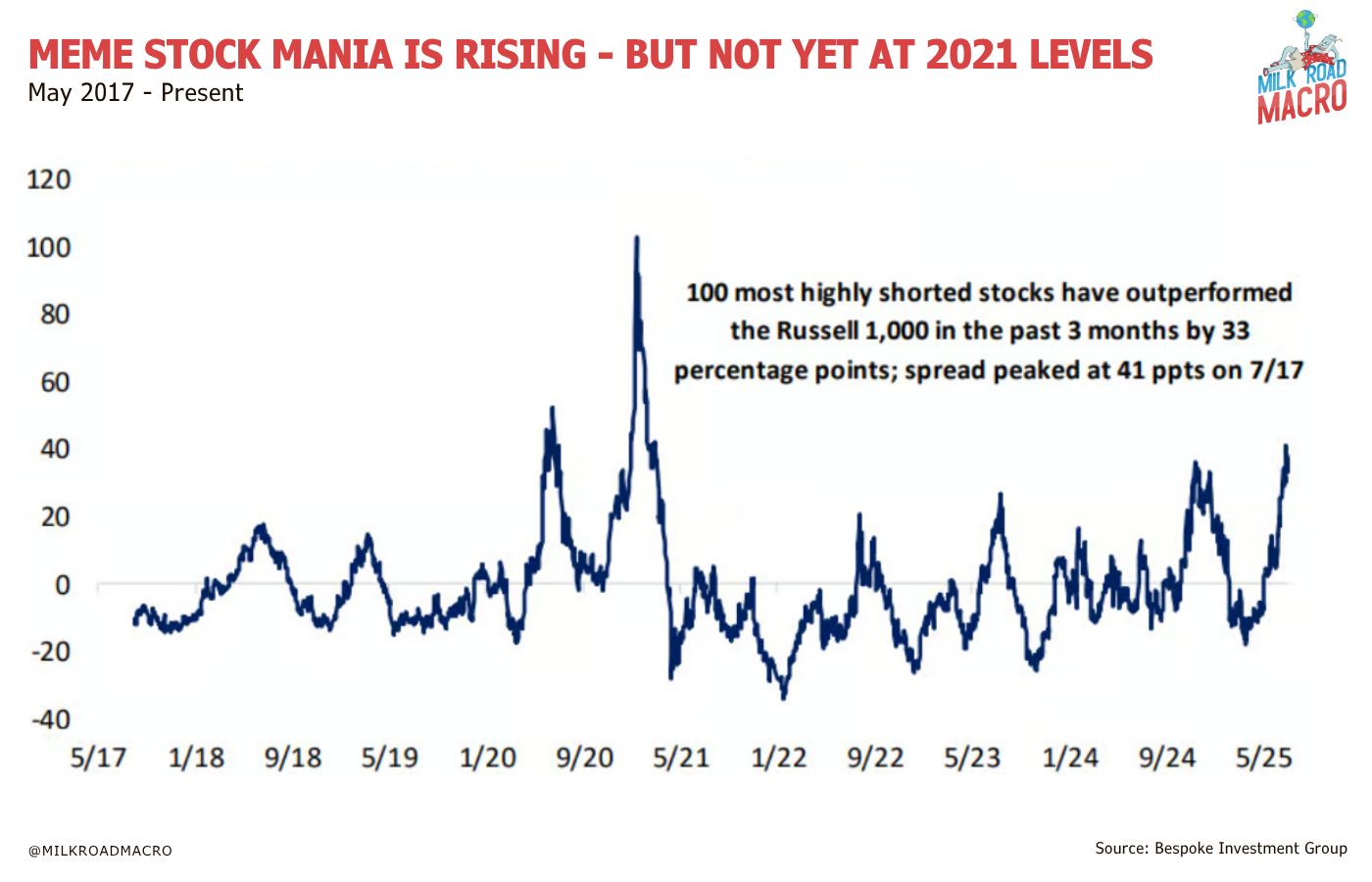

And 2021-style meme stocks are back on the menu.

Traders are piling into heavily shorted companies with low share prices in a bid to strike quick riches.

It’s not GameStop this time though - Kohl’s and Opendoor Technologies are the new meme favorites.

“I’ve been seeing signs of a ‘flight to crap’ recently”, Steve Sosnick, chief strategist at Interactive Brokers, told Bloomberg.

(Steve doesn’t hold back)

The 100 most shorted stocks in the Russell 1,000 (small-cap index) are up 52% over the last three months and have beaten the index by 33 percentage points.

“Not quite 'meme-stock mania' from 2020/2021, but definitely elevated”, according to Bespoke Investment Group.

Wrapping up

The US economy is humming along just fine, credit risk and recession risk are low, and the Government continues to further fuel the economy with historic deficit levels.

We’ve already seen a big run-up in stocks and other risk assets - and growing speculation is now bubbling.

But there’s still plenty of room for more upside according to positioning and sentiment metrics.

However, the dollar may be due for a consolidation period - which could translate into a headwind for risk assets over time.

That’s it for this edition - catch you for the next one.

Trump said he would not go below 15% as he sets so-called reciprocal tariff rates ahead of an August 1 deadline. “We’ll have a straight, simple tariff of anywhere between 15% and 50%”, Trump said Wednesday at an AI summit in Washington.

Treasury Secretary Scott Bessent suggested the Federal Reserve's widely followed economic forecasts are motivated by politics. "The Fed publishes something called a summary of economic projections, and it's pretty politically biased", he said.

Alphabet (Google) stock price surged after reporting solid earnings and a “standout quarter”. The company also dramatically increased its capex spending plans, a further signal of the growing AI capex boom.

RATE TODAY’S EDITION

What'd you think of today's edition? |

MILKY MEME 🤣

ROADIE REVIEW OF THE DAY 🥛